HMRC targets persons with significant control.

In its latest one-to-many campaign, HMRC is writing to persons with significant control (PSC) who have not filed a tax return or may not have declared all their income.

The PSC rules require a company to identify all individuals who can control it and report this information to Companies House. HMRC has reviewed this information and is writing to the PSC where it believes that individual may need to take action. There are two types of letter:

The first letter asks the PSC to check their tax return for 2022/23 and to correct any errors by 23 August 2024. The letter includes guidance on how to do this. The individual is also encouraged to ensure that their tax return for 2023/24 includes all sources of income and gains.

The second letter is aimed at PSCs who have not submitted a tax return. The individual is asked to check if they need to register to submit a return. If a return should have been submitted for 2022/23, they should register and submit the return by 23 August 2024. However, if they fail to do this, HMRC may charge a failure to notify penalty. The individual should contact HMRC using the contact details given in the letter if they do not believe a return is required.

HMRC targets persons with significant control.

In its latest one-to-many campaign, HMRC is writing to persons with significant control (PSC) who have not filed a tax return or may not have declared all their income.

The PSC rules require a company to identify all individuals who can control it and report this information to Companies House. HMRC has reviewed this information and is writing to the PSC where it believes that individual may need to take action. There are two types of letter:

The first letter asks the PSC to check their tax return for 2022/23 and to correct any errors by 23 August 2024. The letter includes guidance on how to do this. The individual is also encouraged to ensure that their tax return for 2023/24 includes all sources of income and gains.

The second letter is aimed at PSCs who have not submitted a tax return. The individual is asked to check if they need to register to submit a return. If a return should have been submitted for 2022/23, they should register and submit the return by 23 August 2024. However, if they fail to do this, HMRC may charge a failure to notify penalty. The individual should contact HMRC using the contact details given in the letter if they do not believe a return is required.

How are the non-dom rules changing?

Labour revealed plans to scrap the non-dom regime in April 2022.

In March 2024, the then Conservative Chancellor Jeremy Hunt announced that the non-dom tax regime would be phased out.

Under Mr Hunt’s plans, individuals who move to the UK from April 2025 would not have to pay tax on money they earned overseas for the first four years.

How are the non-dom rules changing?

Labour revealed plans to scrap the non-dom regime in April 2022.

In March 2024, the then Conservative Chancellor Jeremy Hunt announced that the non-dom tax regime would be phased out.

Under Mr Hunt’s plans, individuals who move to the UK from April 2025 would not have to pay tax on money they earned overseas for the first four years.

More taxpayers can set up a payment plan

From the end of last year, HMRC increased the maximum tax debt that can be included when making a time to pay arrangement online to £30,000 for individuals and £50,000 for businesses.

Taxpayers who cannot pay their tax bill can apply online to set up a time to pay arrangement with HMRC. This includes individuals with self-assessment (SA) liabilities, employers with pay as you earn (PAYE) debts, and businesses with outstanding VAT bills.

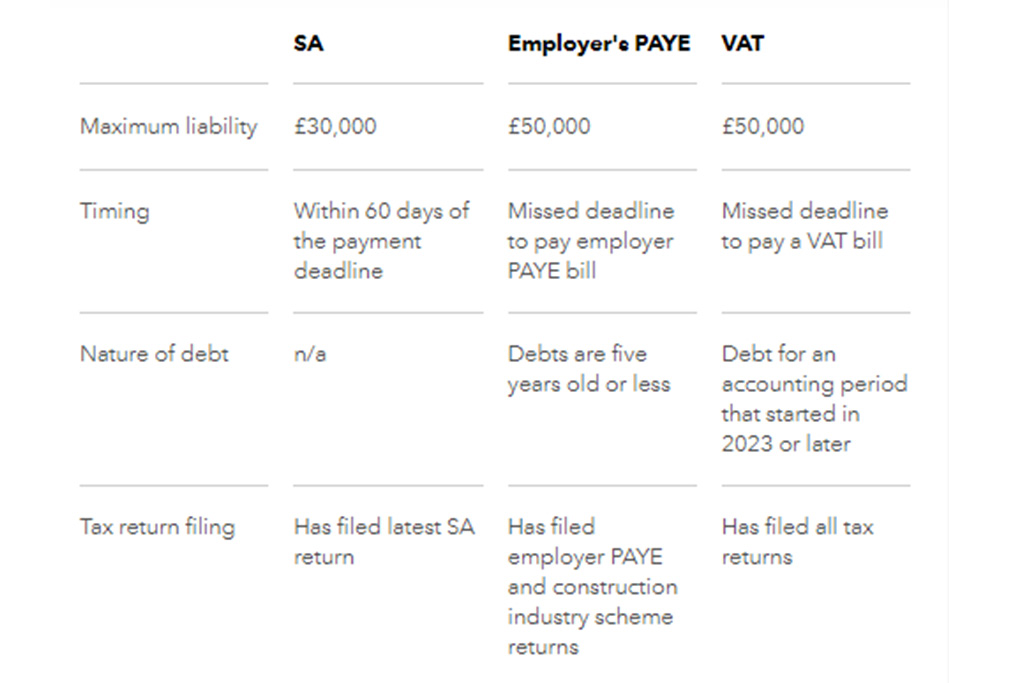

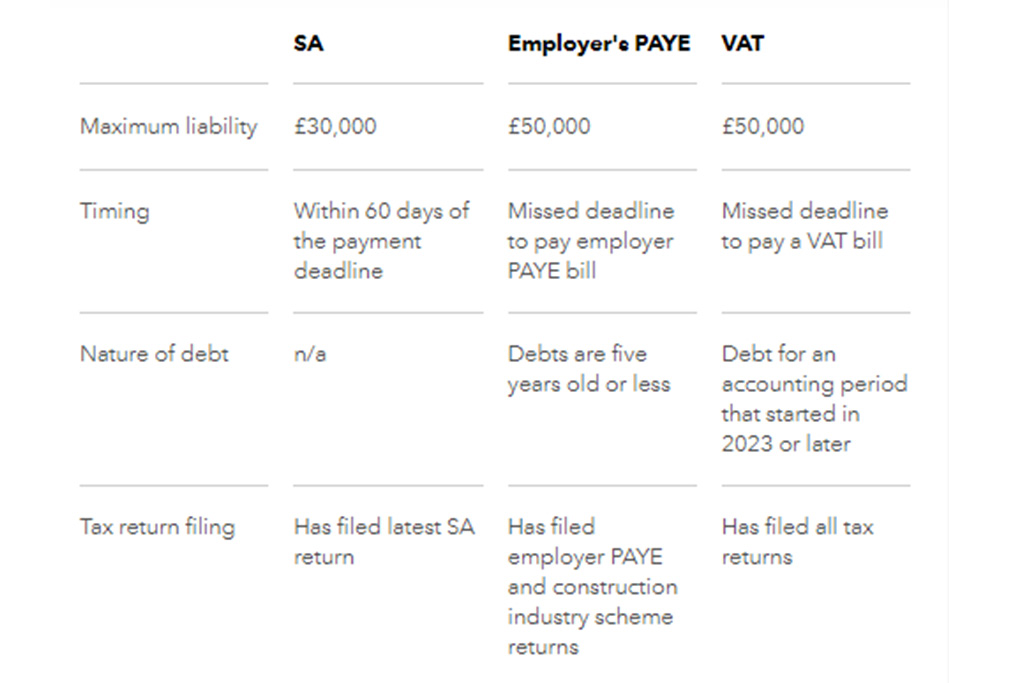

The criteria for applying for a payment plan online, as set out in HMRC’s guidance, are summarised below:

More taxpayers can set up a payment plan

From the end of last year, HMRC increased the maximum tax debt that can be included when making a time to pay arrangement online to £30,000 for individuals and £50,000 for businesses.

Taxpayers who cannot pay their tax bill can apply online to set up a time to pay arrangement with HMRC. This includes individuals with self-assessment (SA) liabilities, employers with pay as you earn (PAYE) debts, and businesses with outstanding VAT bills.

The criteria for applying for a payment plan online, as set out in HMRC’s guidance, are summarised below:

2024 Accounting Predictions, Trends, and What to Expect

- From 6th January 2024, the main rate of National Insurance Contributions (NICs) paid by employees will be reduced from 12% to 10%.

- From 6th April 2024, the main rate of NICs paid by those who are self-employed will be reduced from 9% to 8%.

- The pensions Lifetime Allowance will be abolished.

- The Basis Period Reforms will be introduced, representing a significant change for self-employed individuals and partnerships. Instead of using an accounting period end, these entities will now be taxed on the profits made during the tax year.

- From April 2024, the Capital Gains Tax allowance will be reduced to £3,000 for individuals and to £1,500 for trustees.

- From 1st April 2024, both the National Living Wage (NLW) and the National Minimum Wage (NMW) will increase. The NLW rate will increase to £11.44 per hour, and the NMW will increase to £8.60 for 18-20 year olds, £6.40 for 16-18 year olds and apprentices, and £9.99 when accommodation is provided by the employer.

2024 Accounting Predictions, Trends, and What to Expect

- From 6th January 2024, the main rate of National Insurance Contributions (NICs) paid by employees will be reduced from 12% to 10%.

- From 6th April 2024, the main rate of NICs paid by those who are self-employed will be reduced from 9% to 8%.

- The pensions Lifetime Allowance will be abolished.

- The Basis Period Reforms will be introduced, representing a significant change for self-employed individuals and partnerships. Instead of using an accounting period end, these entities will now be taxed on the profits made during the tax year.

- From April 2024, the Capital Gains Tax allowance will be reduced to £3,000 for individuals and to £1,500 for trustees.

- From 1st April 2024, both the National Living Wage (NLW) and the National Minimum Wage (NMW) will increase. The NLW rate will increase to £11.44 per hour, and the NMW will increase to £8.60 for 18-20 year olds, £6.40 for 16-18 year olds and apprentices, and £9.99 when accommodation is provided by the employer.